Table of Content

This is one of the reasons why independent contractors tend to be paid more hourly than regular employees for the same job. Uncommon.It is important to make the distinction between bi-weekly and semi-monthly, even though they may seem similar at first glance. For the purposes of this calculator, bi-weekly payments occur every other week . Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly).

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator. You have a new job or got a raise and you want to know your salary net of tax? Assuming a 37.5-hour work week, the National Living Wage for a 23-year-old is £356 a week, £1,544 a month, or £18,525 a year.

Take Home Pay Calculator

We'll show you your full pay before and after deductions and then break down each of the items taken from your income. We'll go one step further and show you which tax bands you fall into too. To wrap it all up there will be a quick comparison between the take home pay from the year before (so you can see how much what you take home has changed!). If you know your Bonus, you can enter it OR if you don't know your bonus, you can enter expected amount to get an estimate of you take home and taxes. Note that Bonus is treated as Salary so both Income Tax and NI applied on Bonus. If you need more accurate calculation of your Take Home, enter the Advanced Options and calculate.

Under the PAYE system, all taxes and even deductions like student loan repayments and pension contributions will be taken into account. However, if you're self-employed, you need to complete a self-assessment tax return. To calculate your salary after tax in the UK, simply subtract from your gross salary your income tax and National Insurance contributions. UK taxes are paid using the Pay As You Earn scheme, which means your employer will automatically deduct all taxes and contributions from your wages. In other words, if your taxes are collected through PAYE, then you generally don't have to file a tax return.

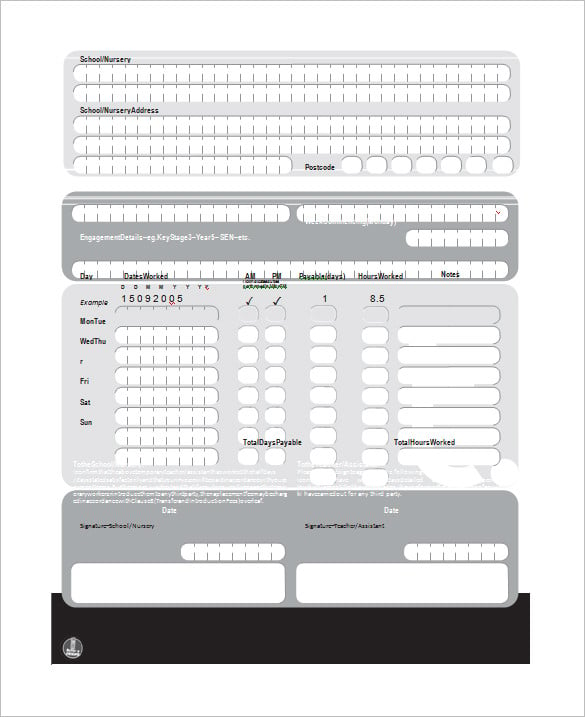

Working Days per Week

For a more dependable estimation, we can look at the median gross salary in the UK, which is £25,356 a year, or £2,113 monthly. However, it's best to take your specific location's median pay into account. For instance, the average pay in inner London and outer London varies from £2,087 in Enfield to £3,297 in Wandsworth (after tax, that's £1,742 and £2,549 respectively).

In the U.S., the concept of personal income or salary usually references the before-tax amount, called gross pay. For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person.

What Is the Minimum Wage in the UK?

Whether a person is an employee or an independent contractor, a certain percentage of gross income will go towards FICA. In the case of employees, they pay half of it, and their employer pays the other half. Independent contractors or self-employed individuals pay the full amount because they are both employees and employers.

You are required to use the cycle for more than 50% of your journeys. You can enter value of cycle to work voucher availed under the Tab 'Salary Sacrifice'. The system generally makes it easier for employees meaning they can avoid having to fill out self assessment forms. Once a tax code is provided to your employer by HMRC, it is their responsibility to correctly deduct tax from your wage.

This nuance is lost if we just look at London as a whole, which has an average salary of £2,548 — after tax that's £2,049 a month. Tax relief is afforded to employees who contribute towards a pension scheme. Consequently, money is paid into your pension which would otherwise have been paid to the government in the form of income tax. If you are paid an hourly-wage or an annual salary, it is important to select the correct time interval to generate an accurate breakdown of your take-home pay.

As an aside, unlike the federal government, states often tax municipal bond interest from securities issued outside a certain state, and many allow a full or partial exemption for pension income. The Costrak salary calculator is intended to provide estimated salary figures and is not intended to be financial advice. You also have the option to get the figures for Annual, monthly, weekly and daily pay. To use the Take home pay salary calculator, you will be required to provide the following information.

Not only will your take home pay be impacted by the standard income tax bands, but also by your personal circumstances . This will largely determine how much you're actually able to be paid. Pop in your details into the take home pay calculator above to see a detailed breakdown. Your Taxable Income is obtained by deducting your personal allowance and deductions for your gross salary. This amount is not deducted from your salary but paid by your employer as benefit.

If you're interested in finding out more about your salary taxes, visit the HMRC website or contact your local tax office. SalaryBot will automatically check to see if you're being paid the minimum wage for your age group. If you find this calculator useful please share it with your friends using the below social media buttons. If you have more than one job, use the calculator once for each job. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year . In general, it is wise to stop contributing towards retirement when facing immediate financial difficulty.

No comments:

Post a Comment